Just when you thought the gig economy evolving has slowed down, out comes ultrafast grocery deliveries. Grocery delivered in 10 to 20 minutes time.

Just to be clear this is not your normal online ordered grocery delivery that has been available for years. This is new and a sub-set. We are not talking about Tesco, Ocada or similar delivery entities.

This is the new battleground for startups. And once again London is the main test bed. Will they succeed?

London’s population critical mass, diversity, close proximity of households and high disposal income makes it ideal for start-ups and the gig economy. If you get it right in London, the World is your oyster.

Though London is prominent, other countries are also in play. Germany and Turkey comes to mind.

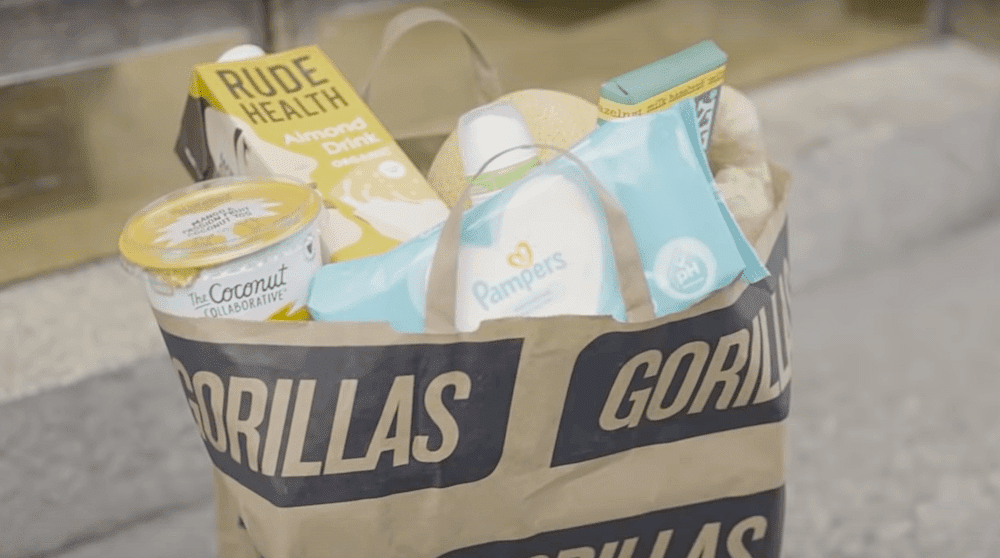

Major players are Getir, Gorillas, Flink, Zapp, Weezy, Djia and more. Getir has since acquired Weezy.

It all kicked off in 2020 with millions of dollars pouring in from venture capitalists and one prominent sovereign fund.

Quick-Commerce

Ultrafast grocery developments are part of Quick-commerce or Q commerce stream. It is to differentiate it from E-commerce. Focus and value proposition on speed of fulfilment.

Again phone apps play a major part as well as the delivery couriers, both of whom reflect mainstream gig economy models.

The key question is the sustainability of this particular model despite the millions that have been poured into many start-ups by venture capitalists.

Model premise

The ultrafast grocery model’s future is premised on a number of factors or beliefs.

The single biggest factor is the price premium that customers are prepared to pay. These are not special items but ordinary items. They can be purchased easily by walking to the store.

That premium and the belief that it will hold has brought in the VC funds.

Remember organic and vegan food products. Many were proven wrong when significant premiums were readily accepted and demand for them shot up across the supermarkets.

The second factor is the new generation of consumers with higher disposal income as well as the fast lifestyle. Time has become a premium and convenience a key attribute.

Covid impact

Though anecdotal, Covid first led to many depending on couriers for delivery in view of restrictions and enforced isolation. Has this behaviour become entrenched?

As the restrictions are progressively lifted, the number of couriers that I see on the roads and in my neighbourhood has not dropped. They have actually increased.

Even the casual chat with my usual eateries and restaurants service staff tell me that food deliveries orders continue to increase.

Nuts and bolts of Q commerce

First is speed. The promise of ultrafast deliveries in minutes. The magic number is 15 minutes with one claiming 10 minutes. Let’s anchor this around 15 to 20 minutes for ultras fast grocery as this is the main focus.

Second is the limited range of inventory. Only essentials, alcohol and over the counter pharmaceuticals, fast moving and popular products. Much smaller than a supermarket. 1,500 distinct products rather than 30,000 that a full sized supermarket carries.

Third is the need to operate stores in a high density residential area to meet the fast delivery time.. Not one but many for a large city as the serving radius for each store is around 3 to 4kms.

They are called dark stores as they not known or open to the public and the public does not need know it. No need for a signboard and the insides furnishings are bare except for shelves to hold inventory.

They are also small, in an alley or out sight.

The last is the use of e-bikes, e-mopeds and motorbikes to make that speedy dash.

This model is more capital intensive than food couriers such as Uber Eats and DoorDash. This model requires leasing multiple dark stores in a city and having it fitted for operations.

Current Strategy

Grow the customer base fast. Really fast. Customers tend to stick to the same provider after two to three successful transactions.

Successful transactions means speed, highly intuitive and responsive phone app and good customer service.

There are also other ways to attract the customers and grow the base fast. Deep discounts and honeymoon teasers have been part and parcel of all start-ups. The same approach that Uber, Deliveroo, Door Dash and all others that came to play. It is the same with Q-commerce and the ultrafast version.

A fast growing base fuels rising valuation and the next rounds of series funding, attracting and paying for more creative and development talent in the software space. These then enable the next phases of growth.

And deep discounts to be clear are prices that are well below supermarket prices. For many why bother walking to the supermarket in the first place when you have something cheaper that includes delivery in 15 minutes. No brainer here.

Remember the early days when Uber and the ride hailing sector were awash with heavy discounts for customers and great rates for drivers. All courtesy of VC capital.

Is the model sustainable

This is probably one initiative and model in the Gig economy that has many champions as well many doubters.

It is safe to say that this model does not have the appeal or the buzz that Uber had when it pioneered ride hailing.

Uber appealed not only to the ride customer but drivers as well. It closed the loop. It also appealed to the media and the general public including the governments. There was palpable excitement in the air.

There was no apparent sense of a void to be filled nor is it considered disruptive when it comes to ultrafast grocery or even ultrafast delivery of products. It did not instil the level of fear to supermarkets as Uber did to the taxi industry.

Likely outcome

Sector consolidation which has begun will become the first obvious outcome. Venture capitalists will unload once the customer base size becomes attractive to bigger players. Gone are the days for the final toll-gate, the IPO.

Remember these entities are not yet profitable as a business. The valuation and sale price nevertheless would provide them with a significant return for their investment.

Supermarket chains with their outsourced delivery model are now offering express delivery service. Not ultrafast but from 30 to 60 minutes onwards. Their product range is 25 times wider, no need for dark stores or mini-warehouses and prices do not carry a premium. Looks more sustainable.

Remember Amazon groundbreaking Prime which was not expected to survive. It is now a billion dollar business. It’s Amazon’s express model with a membership fee. Yes, 200 million paid members. While Prime model is express delivery it does not do ultrafast grocery or any product ultrafast and therein lies the answer.

Pingback: The Zapp model - Adelaide wide open