The Zapp model started out different. And I am sure some wondered why.

Its an interesting case study of a start-up and its novel operating model. An attempt to come from a different direction.

Founded in 2020 and launched in London it began to grow fast. The difference was intriguing as it differed from all the competitors.

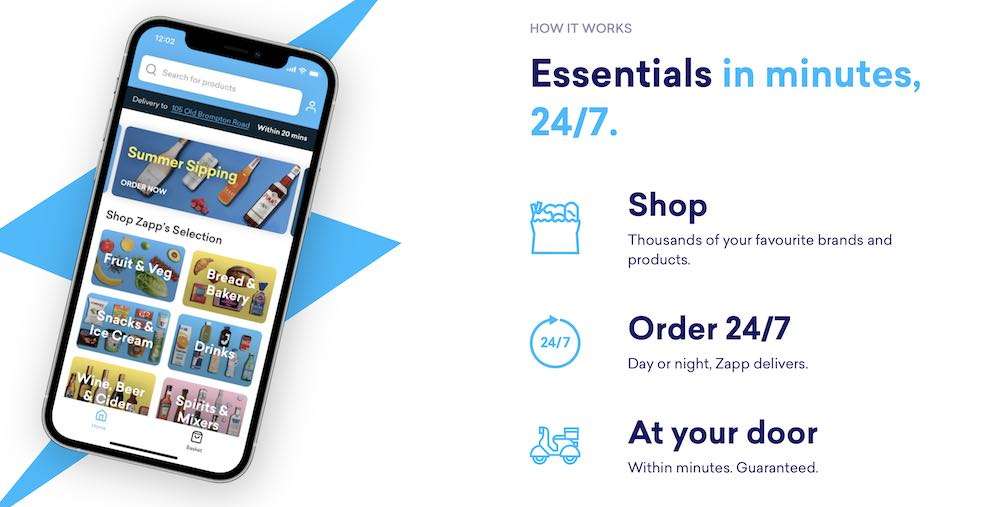

In the main it’s an on-demand grocery and essentials ultrafast delivery model. No different to other Ultrafast delivery companies that began in Europe. But is it part of the gig economy like their competitors?

Like other ultrafast delivery companies , it was a dark store operator, a start-up and has all the hallmarks of the gig economy. They started with 10 minutes and now it is 20 minutes from the time the order is placed to the doorstep. Even 20 minutes is crazy fast. Putting into context, you place an order, go take a bath and your door bell will ring as you finish your bath.

London start

Zapp on-demand starting in London was not a surprise as London is a favourite test bed for start-ups. They launched in select UK cities like Manchester, Cambridge and Bristol. A year later they opened in Amsterdam and then Paris .

Zapp was founded by Joe Falter of Jumia and Navid Hadzaad of Amazon. Two techies in the deep end of technology. The leadership comprises of people who have come from Deliveroo, Tesco, Just Eat and Domino’s.

I have covered ultrafast grocery and essential deliveries in an earlier post as it is the latest battlefield for delivery start-ups using the gig model. This post is about a one particular company and it’s significant model deviation from the gig model.

Zapp’s difference

Zapp made a bold statement at the time of start-up in 2020 and it caught my attention. They specifically stated that they are “unlike” others in regard to one major aspect of the gig economy model. Their delivery riders were to be classified as employees. A major deviation then. A paradigm shift.

The other thing that intrigued me were the type of investors and venture capitalists they were attracting which included one major sovereign fund. My guess is that the paradigm shift attracted them.

The gig economy model difference

The single most important part of the gig economy model is the nature of the workforce such as couriers, delivery riders, ride hail drivers etc who are not considered employees. Self-employed or independent contractors were the norm.

The very essence of the word “gig” in the gig economy is telling. Its an engagement, not a permanent position of employment. Is it a gig when there is sense of permanency among the majority engaged?

Workforce flexibility

Flexibility is a sub-component of the gig economy model. The workforce is allowed to choose work hours and when work had to be done.

That flexibility became a major attracting feature as it started to draw people from a particular segment of society.

People not seeking full time employment for various reasons became a recruitment source. Students and those already in full time employment but have some hours to spare to supplement their income became part of the equation.

Zapp’s employees

The Zapp model of classifying their delivery riders as employees and operate like any other company employees in a country has significant implications. In one single swoop, it took itself out of the gig economy. As least for me.

Remember there are a suite of laws and regulations that has to be followed when someone is classified as an employee. There are also indirect financial consideration. such as payroll tax, statutory pension fund contribution etc. A significant operating cost component for any business.

So Zapp took on a challenge that others did not, at least voluntarily. It was indeed a big ask.

Why the shift by Zapp?

One possible reason is the on-going lawsuits, announcements by various regulators, activists and unions to classify gig workforce as full time employees especially in Europe. Was the Zapp model pre-empting an outcome?

The second reason is to differentiate from the competition both for brand building and to attract quality staff.

Potential candidates who would not have applied for gig positions but would be keen on permanent employment is a consideration. It is a larger pool to work with. Zapp could still provide contracts for part-time and those seeking reduced hours and handle and meet the attraction of flexibility.

There was another interesting thing that the Zapp model pushed across as part of it’s brand and identity. “Fair on the planet” You cannot be fair on the planet without being fair with your workforce..

Fair on the planet

From the start, this was the 3rd and important pillar of their brand approach. Also a key brand building strategy.

They started with an all electric fleet of e-bikes and e-moped and their delivery packaging is made of sustainable materials. It beginning to come across as a model that was worked from the ground up. In a way it’s genesis was not the usual gig economy template.

There are similarities to the vegan movement and the pricing of vegan products. Never did I think vegan products would grow explosively, taking up more aisle and shelf space in supermarkets despite the premium prices. People especially the newer generation are prepared to pay to achieve sustainable practices.

So the Zapp model also was building an identity that differed from its competitors. A brand and ethos that would be attractive to the younger generation who are certainly the target market of ultrafast delivery services. It was a punt, a gamble despite the higher cost.

Also explains why certain group of investors and venture capitalists were attracted to the Zapp model. It was not just a business but ethics playing a big part.

Zapp’s trajectory

Until the first quarter of 2022, all signs indicated a positive outlook. Particularly on the back of its successful Series B funding of USD 200M.

Then the tide turned.

Regulatory pressure and court rulings in Europe, began to force the hands of their competitors. The re-classification of delivery workforce from self-employed to employees started in early 2021. The wages and the benefits such as paid holidays and pension contribution of competitors began to match Zapp and somewhat levelled the playing field. Zapp’s value proposition took a hit. It’s primary differentiator was gone.

Just Eat, the major Dutch and European competitor made the first move in early 2021 for 12 of its European markets including London by providing employee benefits for its couriers. It employed the ”scoober model” where a 3rd party would be contracted to supply courier services and the 3rd party would employ the couriers as employees. Getir a European major player also followed suit.

Contracts from casual, part-time to full time, weekend, holiday days jobs etc and hours worked started from 6 hrs to 40 hours. So there is still flexibility built in and similar to the usual gig economy approach.

Future of Zapp and its competitors

In May 2022, Zapp began withdrawing from 4 UK cities such as Bristol, Manchester and Cambridge and holding on to London in the UK. It was not a good sign as they announced redundancies for 10% of their workforce. Their advertisements for delivery rider recruitment also dried up.

In July 2022, they announced withdrawal from the Netherlands citing Dutch regulatory enforcement of dark stores operating in residential areas. All that remains is London and Paris.

It does look bleak for Zapp. More importantly they did not scale in time and their funding was much smaller than some of the bigger competitors.

Zapp could not play the long game like their competitors. I suspect Zapp will be absorbed by their competitors in a matter of months.

Not just Zapp

Ultrafast grocery and essentials delivery service have an Achilles heel, their dark stores. I have covered the concerning issues behind dark stores in a separate earlier post.

Dark stores which are essential for ultrafast deliveries has to be in residential areas to reach the customers in time. Remember the 20 minutes.

Zoning laws however did not allow it or new zoning laws were being enacted to address the noise and traffic arising from dark store operations. Not just for Zapp but all ultrafast delivery services. So it does look bleak for their competitors as well.

Netherlands began enforcing their city zonal regulations and it began biting. And the days of the dark stores are indeed numbered. Zapp announced its withdrawal in July 2022.

My guess is this sub-segment of the delivery and courier will eventually morph back to the older model of delivery with some variations – possibly delivery within the hour and a premium delivery fee to cover costs.

Market consolidation is also a given as smaller players with limited funding and lack of scale can no longer survive.

One last point. None of the Ultrafast Grocery delivery start-ups have reported profits and investors with the exception of Getir in Turkey. And for Getir only 1 out of 9 countries that they operate in. And investors are becoming impatient.

Pingback: Deliveroo leaves Australia - Adelaide wide open